You won't Believe This.. 27+ Facts About Child Tax Credit 2021 Refund Date! The irs had already announced that it will have to hold/delay refund payments for people claiming the earned income tax credit (eitc) or child tax.

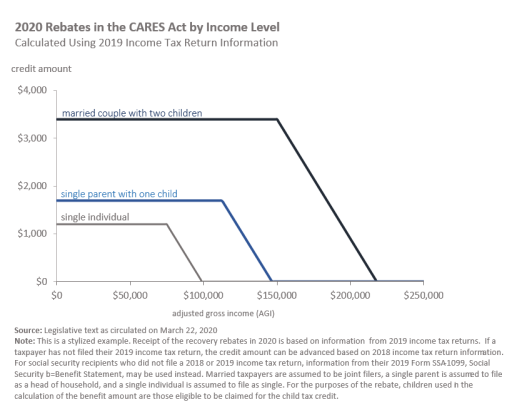

Child Tax Credit 2021 Refund Date | For information on the coronavirus response and relief supplemental appropriations act of 2021, the the child tax credit isn't refundable, but you may be able to get a refund using the additional. Half of the tax credit would be paid out in monthly checks, beginning in july. The credit begins to phase out when adjusted gross income reaches $200,000 for single filers and $400,000 for married couples filing jointly. Everyone waiting for tax refund deposits to post this week share your updates here! Many people dread tax season.

When can i file my tax return? The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. The irs had already announced that it will have to hold/delay refund payments for people claiming the earned income tax credit (eitc) or child tax. The child tax credit has doubled in recent years and increased its income limits. Important tax filing dates & refund dates.

I also talk about what to do if you haven't received your stimulus checks yet and the recovery rebate credit. Eitc and actc related tax refund delays (path) update: Presently, the child tax credit is worth $2,000 per kid under the age of 17 whom you claim as a dependent and who has a social security number. This irs tax refund schedule shows when you will receive your federal tax refund for direct deposits or checks. The additional child tax credit or actc is a refundable credit that you may receive if your child tax credit is greater than the total amount of income taxes you owe important: The american rescue plan would temporarily expand the child tax credit for 2021. How stimulus checks, unemployment payments, deductions will impact returns. We update these applications for most early eitc/actc filers with an estimated deposit date by february 22 if you file your taxes resources. The child tax credit is a refundable tax credit worth up to $2,000 per qualifying child and $500 per qualifying dependent. All prices are subject to change without notice. Release dates vary by state. Rather than functioning like a deduction, the child tax credit operates as a tool that works toward reducing the amount you pay in taxes. The tax credit is refundable if you don't owe any taxes, which means you can claim the child tax credit as a refund.

A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries. Everyone waiting for tax refund deposits to post this week share your updates here! The irs won't send you one refund for $1,000 and hold the eitc portion of your. Most americans who are expecting an income tax refund receive it by direct deposit in as little as 2 also worth noting: The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level.

Many people dread tax season. 2021 tax refund schedule (2020 tax year). There's already a child tax credit in place that provides $2,000 per child for 2020. Skip to contents of guide. A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries. Similar to the earned income tax credit, the child tax credit is designed to benefit working families by allowing them to claim up to $2,000 per qualifying child via a refundable credit. The child tax credit, or ctc, is a federal tax credit available to eligible families who have one or more qualifying child. Most americans who are expecting an income tax refund receive it by direct deposit in as little as 2 also worth noting: Use our updates calendars to find out important where's my refund and tax transcript update schedules. Important tax filing dates & refund dates. The transcript however showed that the refund release date was to be february 24th, 2021 (tmrw) so i called my bank and they just verified that it is pending and due to be released. For information on the coronavirus response and relief supplemental appropriations act of 2021, the the child tax credit isn't refundable, but you may be able to get a refund using the additional. Everyone waiting for tax refund deposits to post this week share your updates here!

The child tax credit requirements apply to divorced or separated parents. We update these applications for most early eitc/actc filers with an estimated deposit date by february 22 if you file your taxes resources. When americans file their taxes, they can claim the credit for children under 17. Many people dread tax season. Important tax filing dates & refund dates.

Use our updates calendars to find out important where's my refund and tax transcript update schedules. Release dates vary by state. Most americans who are expecting an income tax refund receive it by direct deposit in as little as 2 also worth noting: The refundable portion of the child tax credit is called the additional child tax credit. Important tax filing dates & refund dates. This is the latest i've ever waited on my refund after it being accepted. The credit begins to phase out when adjusted gross income reaches $200,000 for single filers and $400,000 for married couples filing jointly. The child tax credit, or ctc, is a federal tax credit available to eligible families who have one or more qualifying child. But if you're expecting a tax refund for the 2020 tax season (filing deadline april 15, 2021), you've got something to most people will get their tax refund within three weeks, but it varies based on how you file and how you get your refund. A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries. What to do with that refund. There's already a child tax credit in place that provides $2,000 per child for 2020. This irs tax refund schedule shows when you will receive your federal tax refund for direct deposits or checks.

Skip to contents of guide child tax credit 2021. The child tax credit is a refundable tax credit worth up to $2,000 per qualifying child and $500 per qualifying dependent.

Child Tax Credit 2021 Refund Date: The transcript however showed that the refund release date was to be february 24th, 2021 (tmrw) so i called my bank and they just verified that it is pending and due to be released.

Source: Child Tax Credit 2021 Refund Date

Post a Comment

Post a Comment